Revocable Trust Template

Revocable Trust Template - Serving as a trustee of a trust can be a huge responsibility, so trustees are entitled to compensation for their work. A revocable trust is one that may be changed or rescinded by the person who created it. If i create a living trust, should i reassign the ownership of my life insurance policies to the living trust? The person creating the trust, sometimes called the. When leaving a home to your children, you can avoid probate by using either joint ownership or a revocable trust, but which is the better method? Differences in structure once you establish an irrevocable trust, you cannot cancel or revoke it. If i put the house in an irrevocable trust, can i still withdraw from my home equity loan, or will. I think i need to at least change the ben. Medicaid considers the principal of such trusts (that is, the funds that make up the. Either make it payable directly to beneficiaries. The person creating the trust, sometimes called the. Serving as a trustee of a trust can be a huge responsibility, so trustees are entitled to compensation for their work. If i create a living trust, should i reassign the ownership of my life insurance policies to the living trust? Differences in structure once you establish an irrevocable trust, you cannot cancel or revoke it. Revocable trusts are generally used for the following purposes: I think i need to at least change the ben. Either make it payable directly to beneficiaries. When leaving a home to your children, you can avoid probate by using either joint ownership or a revocable trust, but which is the better method? Revocable trusts are an effective way to avoid probate and provide for asset management should you ever lose capacity. Revocable trusts permit the named trustee to administer and invest the trust. When leaving a home to your children, you can avoid probate by using either joint ownership or a revocable trust, but which is the better method? Medicaid considers the principal of such trusts (that is, the funds that make up the. Revocable trusts are generally used for the following purposes: The amount of compensation depend. I think i need to. If i create a living trust, should i reassign the ownership of my life insurance policies to the living trust? Either make it payable directly to beneficiaries. A revocable trust is one that may be changed or rescinded by the person who created it. Differences in structure once you establish an irrevocable trust, you cannot cancel or revoke it. Revocable. Differences in structure once you establish an irrevocable trust, you cannot cancel or revoke it. Revocable trusts are an effective way to avoid probate and provide for asset management should you ever lose capacity. I think i need to at least change the ben. When leaving a home to your children, you can avoid probate by using either joint ownership. When leaving a home to your children, you can avoid probate by using either joint ownership or a revocable trust, but which is the better method? I have a mortgage and a home equity loan outstanding. The person creating the trust, sometimes called the. A revocable trust is one that may be changed or rescinded by the person who created. Revocable trusts are an effective way to avoid probate and provide for asset management should you ever lose capacity. Revocable trusts permit the named trustee to administer and invest the trust. Revocable trusts are generally used for the following purposes: The amount of compensation depend. Medicaid considers the principal of such trusts (that is, the funds that make up the. Serving as a trustee of a trust can be a huge responsibility, so trustees are entitled to compensation for their work. Revocable trusts are an effective way to avoid probate and provide for asset management should you ever lose capacity. I think i need to at least change the ben. If i create a living trust, should i reassign the. The amount of compensation depend. When leaving a home to your children, you can avoid probate by using either joint ownership or a revocable trust, but which is the better method? Revocable trusts are an effective way to avoid probate and provide for asset management should you ever lose capacity. Revocable trusts permit the named trustee to administer and invest. The person creating the trust, sometimes called the. Differences in structure once you establish an irrevocable trust, you cannot cancel or revoke it. If i create a living trust, should i reassign the ownership of my life insurance policies to the living trust? I think i need to at least change the ben. I have a mortgage and a home. When leaving a home to your children, you can avoid probate by using either joint ownership or a revocable trust, but which is the better method? Revocable trusts are generally used for the following purposes: I have a mortgage and a home equity loan outstanding. Revocable trusts permit the named trustee to administer and invest the trust. The amount of. I think i need to at least change the ben. Differences in structure once you establish an irrevocable trust, you cannot cancel or revoke it. Revocable trusts permit the named trustee to administer and invest the trust. Serving as a trustee of a trust can be a huge responsibility, so trustees are entitled to compensation for their work. I have. Revocable trusts are generally used for the following purposes: I think i need to at least change the ben. The amount of compensation depend. Medicaid considers the principal of such trusts (that is, the funds that make up the. Serving as a trustee of a trust can be a huge responsibility, so trustees are entitled to compensation for their work. Either make it payable directly to beneficiaries. Differences in structure once you establish an irrevocable trust, you cannot cancel or revoke it. Revocable trusts permit the named trustee to administer and invest the trust. When leaving a home to your children, you can avoid probate by using either joint ownership or a revocable trust, but which is the better method? A revocable trust is one that may be changed or rescinded by the person who created it. I have a mortgage and a home equity loan outstanding. Revocable trusts are an effective way to avoid probate and provide for asset management should you ever lose capacity.Revocable Living Trust Form Fill Out, Sign Online and Download PDF

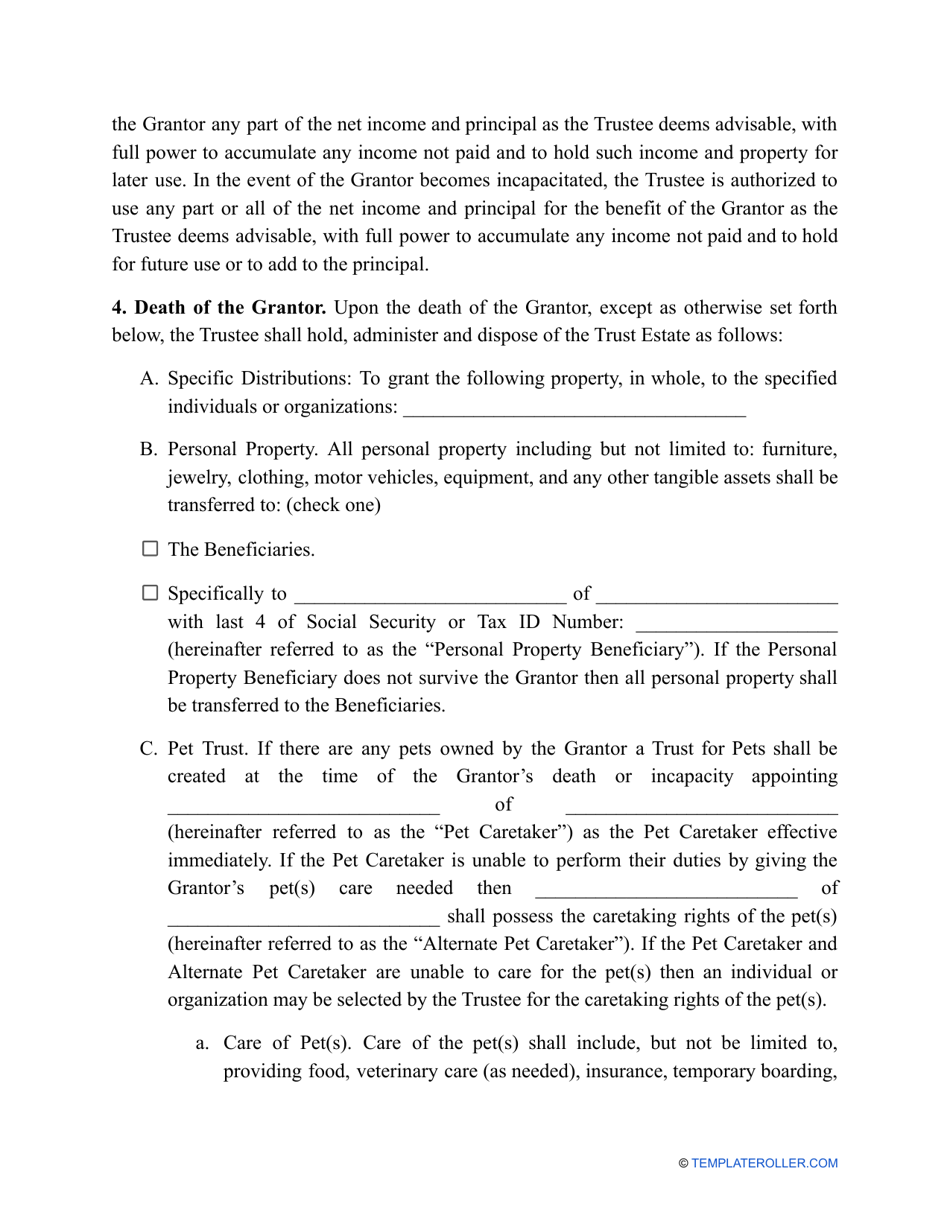

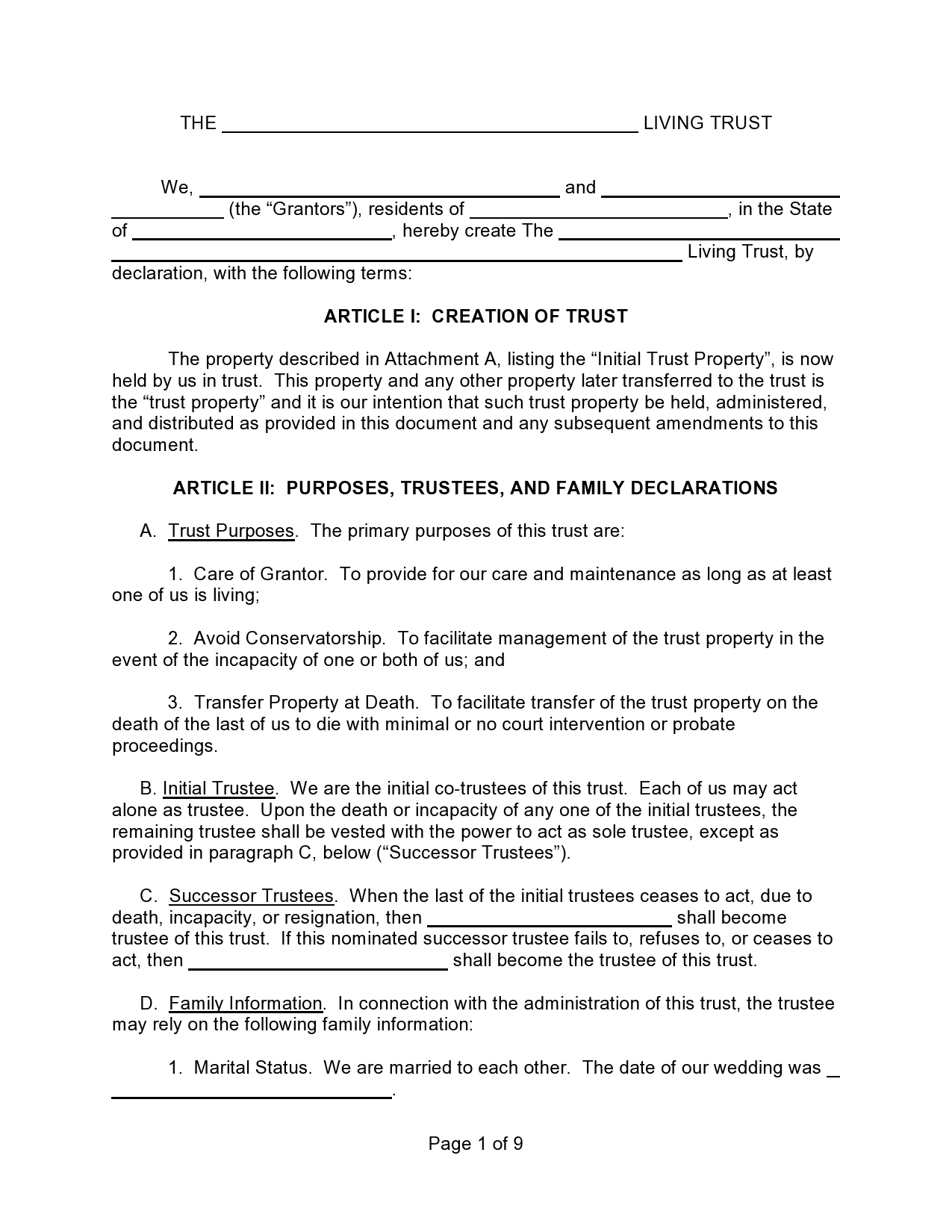

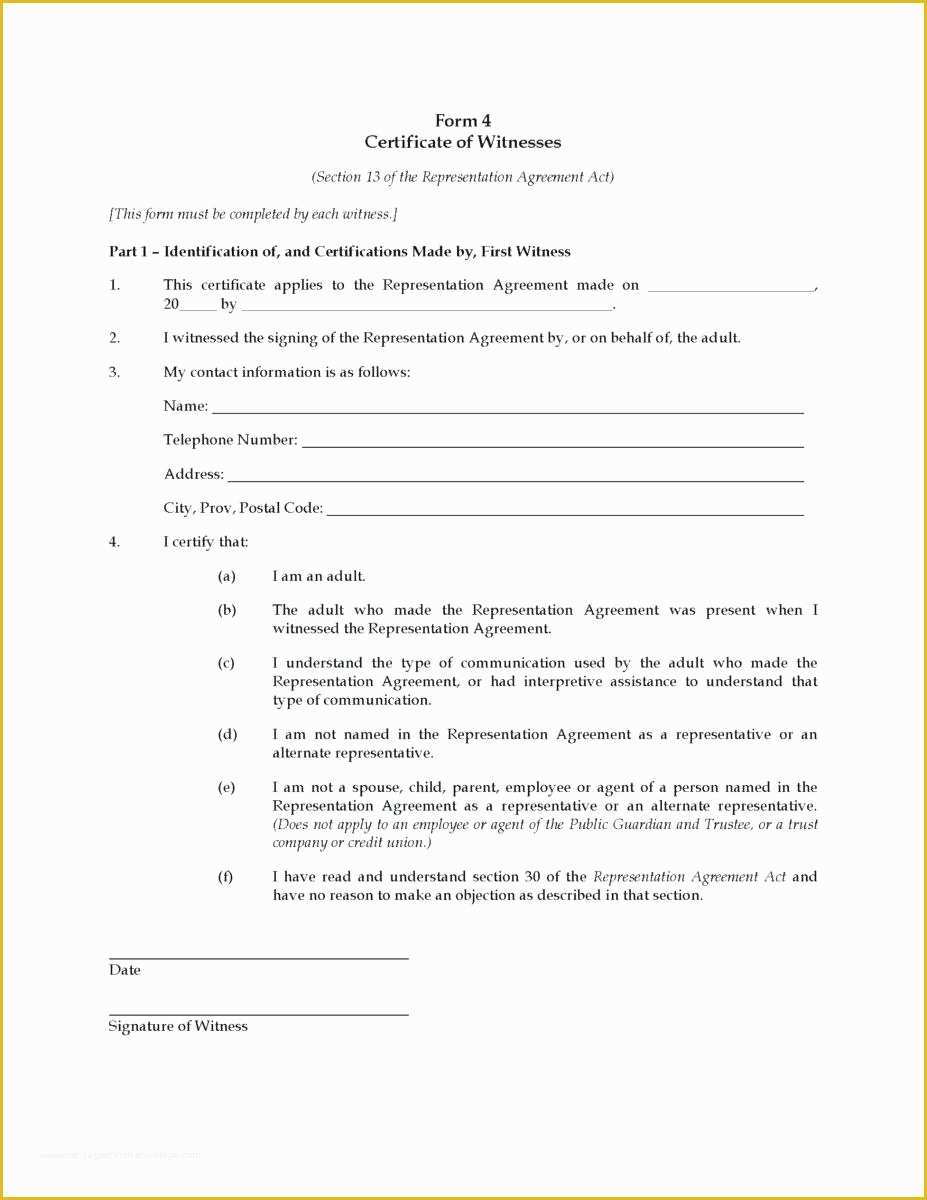

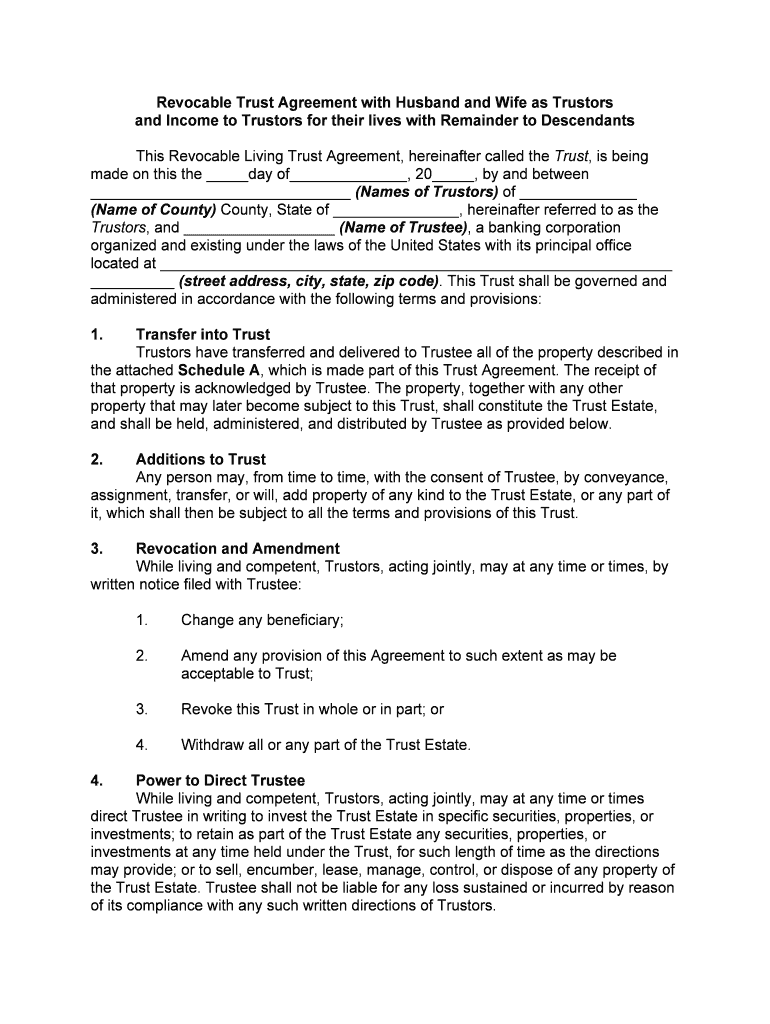

34 Free Living Trust Forms ( & Documents) ᐅ TemplateLab

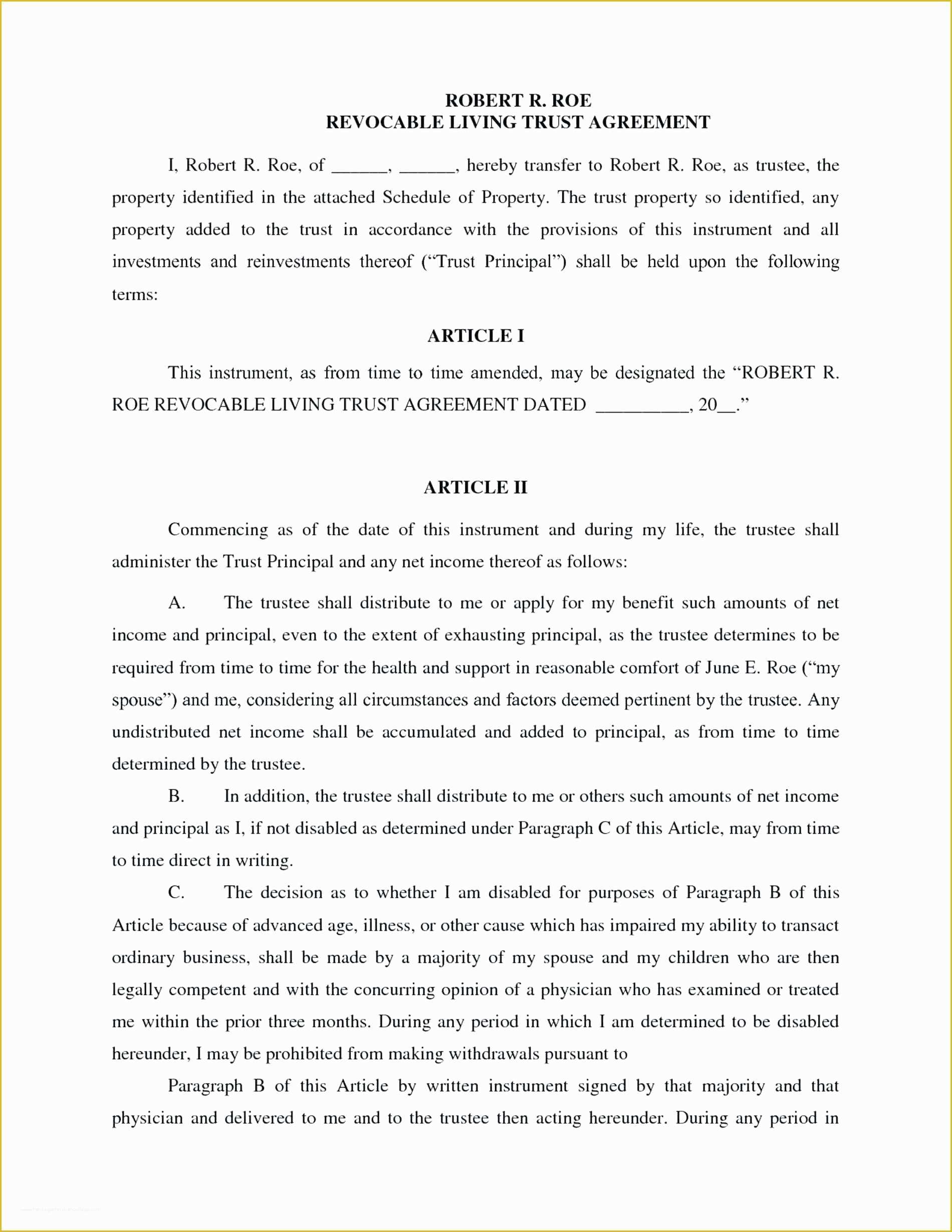

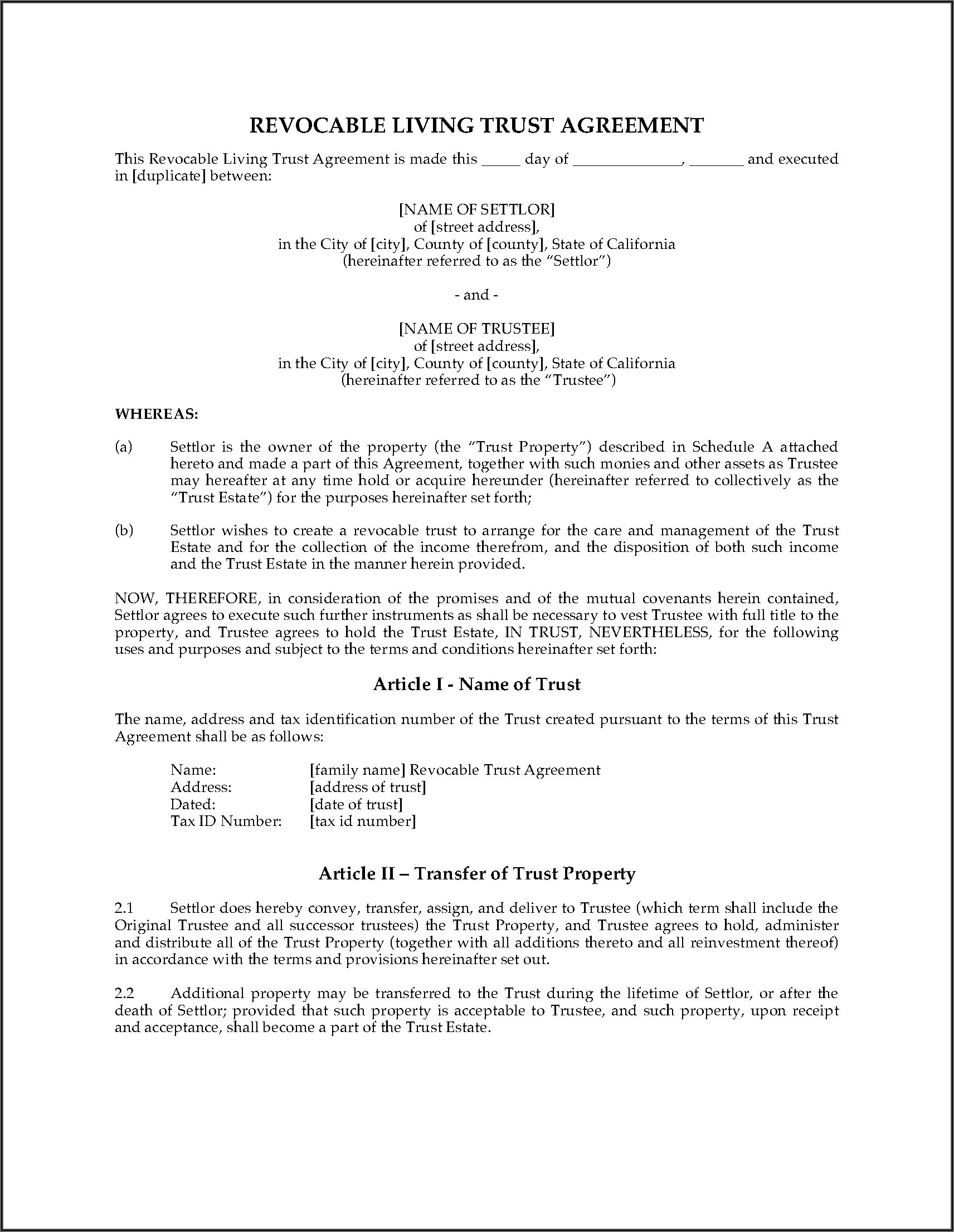

California Revocable Living Trust Template

Free Printable Revocable Living Trust Form Printable Forms Free Online

Revocable Trust Amendment Sample Form Resume Examples dP9l73W12R

Revocable Trust Template PDF Trustee Mortgage Law

Form Revocable Trust Fill Online, Printable, Fillable, Blank pdfFiller

Free Revocable Trust Template Form Resume Examples MeVRBgMyVD

Free Revocable Living Trust PDF Word

Revocable Trust Template PDF Trust Law Trustee

If I Create A Living Trust, Should I Reassign The Ownership Of My Life Insurance Policies To The Living Trust?

The Person Creating The Trust, Sometimes Called The.

If I Put The House In An Irrevocable Trust, Can I Still Withdraw From My Home Equity Loan, Or Will.

Related Post: