Refund Receipt Template

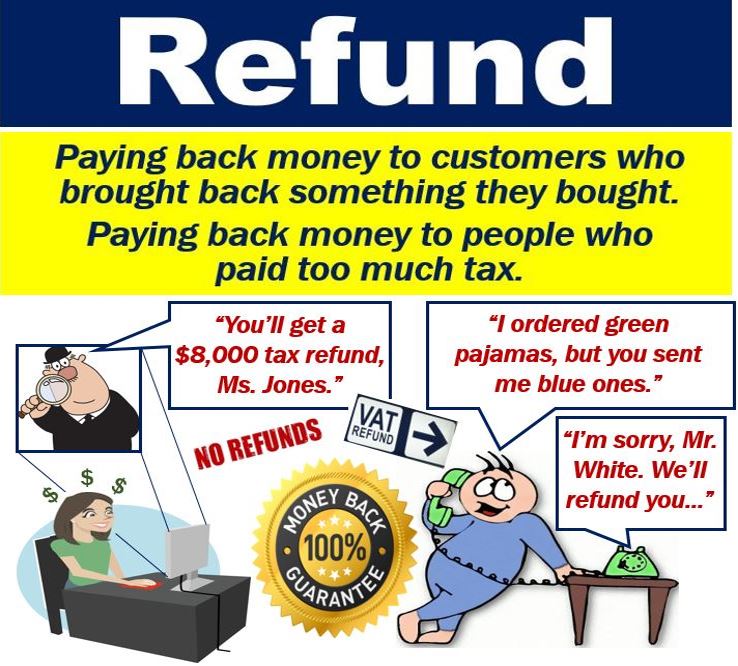

Refund Receipt Template - Taxpayers who file electronically can typically use the where’s my refund? The taxpayer advocate service’s refund information can help you get answers to common questions about refunds. Refund status is available within 24 hours. It takes about four weeks for the same. Taxpayers can check the status of their refund easily and conveniently with the irs where's my refund tool at irs.gov/refunds. Check the status of your federal income tax refund using irs2go. Tool to check the status of a tax refund within 24 hours of filing. Where's my refund?, one of irs's most popular online features, gives you information about your federal income tax refund. It's available anytime on irs.gov or through the irs2go app. Please enter your social security number, tax year, your filing status, and the refund amount as shown on your tax return. It's available anytime on irs.gov or through the irs2go app. It takes about four weeks for the same. Need help with tax refund information? The taxpayer advocate service’s refund information can help you get answers to common questions about refunds. Your social security number or individual taxpayer. You can start checking on the status of your refund after about 4 weeks. See your personalized refund date as soon as the irs processes your tax return and approves your refund. Where's my refund?, one of irs's most popular online features, gives you information about your federal income tax refund. Taxpayers can check the status of their refund easily and conveniently with the irs where's my refund tool at irs.gov/refunds. Please enter your social security number, tax year, your filing status, and the refund amount as shown on your tax return. Refund status is available within 24 hours. Where's my refund?, one of irs's most popular online features, gives you information about your federal income tax refund. The tool tracks your refund's progress. Tool to check the status of a tax refund within 24 hours of filing. Taxpayers who file electronically can typically use the where’s my refund? Explore options for getting your federal tax refund, how to check your refund status, how to adjust next year’s refund and how to resolve refund problems. See your personalized refund date as soon as the irs processes your tax return and approves your refund. The tool tracks your refund's progress. Where's my refund?, one of irs's most popular online features,. Taxpayers can check the status of their refund easily and conveniently with the irs where's my refund tool at irs.gov/refunds. Taxpayers who file electronically can typically use the where’s my refund? The tool tracks your refund's progress. Tool to check the status of a tax refund within 24 hours of filing. Explore options for getting your federal tax refund, how. See your personalized refund date as soon as the irs processes your tax return and approves your refund. All fields marked with an asterisk (*) are required. It takes about four weeks for the same. The taxpayer advocate service’s refund information can help you get answers to common questions about refunds. Refund status is available within 24 hours. It takes about four weeks for the same. Need help with tax refund information? The tool tracks your refund's progress. Please enter your social security number, tax year, your filing status, and the refund amount as shown on your tax return. Taxpayers who file electronically can typically use the where’s my refund? Explore options for getting your federal tax refund, how to check your refund status, how to adjust next year’s refund and how to resolve refund problems. All fields marked with an asterisk (*) are required. Need help with tax refund information? Your social security number or individual taxpayer. It takes about four weeks for the same. See your personalized refund date as soon as the irs processes your tax return and approves your refund. The tool tracks your refund's progress. To view your refund status, you will need: The taxpayer advocate service’s refund information can help you get answers to common questions about refunds. Refund status is available within 24 hours. Explore options for getting your federal tax refund, how to check your refund status, how to adjust next year’s refund and how to resolve refund problems. Please enter your social security number, tax year, your filing status, and the refund amount as shown on your tax return. See your personalized refund date as soon as the irs processes your tax. Explore options for getting your federal tax refund, how to check your refund status, how to adjust next year’s refund and how to resolve refund problems. To view your refund status, you will need: Taxpayers who file electronically can typically use the where’s my refund? Please enter your social security number, tax year, your filing status, and the refund amount. Check the status of your federal income tax refund using irs2go. Taxpayers who file electronically can typically use the where’s my refund? Explore options for getting your federal tax refund, how to check your refund status, how to adjust next year’s refund and how to resolve refund problems. To view your refund status, you will need: See your personalized refund. It takes about four weeks for the same. Refund status is available within 24 hours. All fields marked with an asterisk (*) are required. The tool tracks your refund's progress. Need help with tax refund information? Your social security number or individual taxpayer. Taxpayers who file electronically can typically use the where’s my refund? To view your refund status, you will need: Where's my refund?, one of irs's most popular online features, gives you information about your federal income tax refund. Tool to check the status of a tax refund within 24 hours of filing. Explore options for getting your federal tax refund, how to check your refund status, how to adjust next year’s refund and how to resolve refund problems. Please enter your social security number, tax year, your filing status, and the refund amount as shown on your tax return. You can start checking on the status of your refund after about 4 weeks. Check the status of your federal income tax refund using irs2go.What is a refund? Definition and examples Market Business News

Free of Charge Creative Commons refund Image Financial 3

refund stamp red rubber stamp on white background. refund stamp sign

When Is State Refunds Issued 2025 Lissy Phyllys

Entitled to a Shipping Refund? Get Help Collecting It. Entrepreneur

How Long Is It Taking To Get Tax Refunds 2024 Legra Natalee

8,440 Customer refund Images, Stock Photos & Vectors Shutterstock

Money Matters What should you do with a tax refund TBR News Media

How to Successfully Request a Refund from BetterHelp [2025]

Return Goods

The Taxpayer Advocate Service’s Refund Information Can Help You Get Answers To Common Questions About Refunds.

See Your Personalized Refund Date As Soon As The Irs Processes Your Tax Return And Approves Your Refund.

It's Available Anytime On Irs.gov Or Through The Irs2Go App.

Taxpayers Can Check The Status Of Their Refund Easily And Conveniently With The Irs Where's My Refund Tool At Irs.gov/Refunds.

Related Post:

![How to Successfully Request a Refund from BetterHelp [2025]](https://therapyhelpers.com/wp-content/uploads/2023/11/betterhelp-refund-1-1024x603.jpg)