Expenses And Income Spreadsheet Template For Small Business

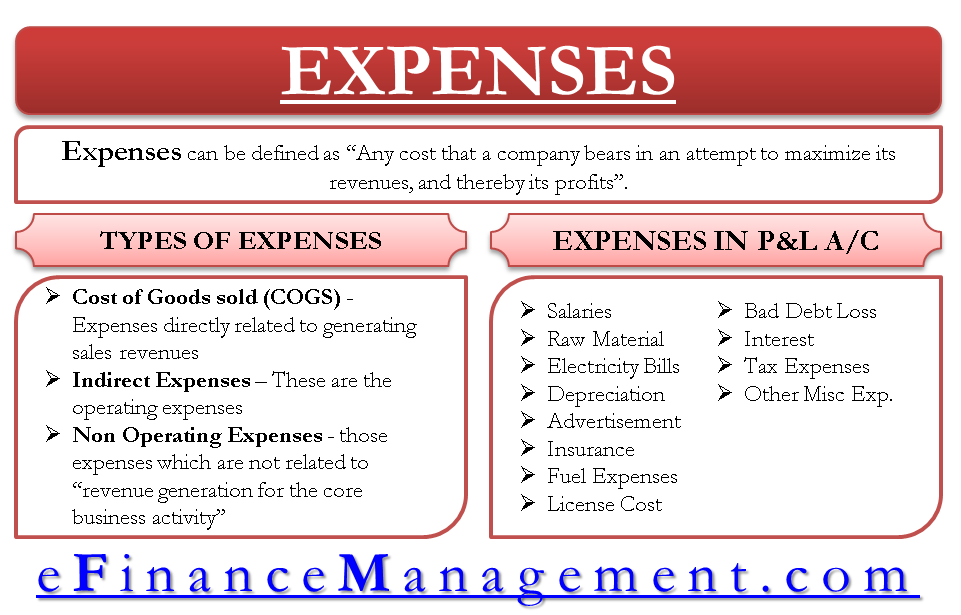

Expenses And Income Spreadsheet Template For Small Business - An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a phone bill) and big purchases made by. For example, a person who buys a new truck for a business would be making a capital expenditure because. How to use expense in a sentence. This includes money spent on items such as rent, office supplies, and salaries for employees. Expenses are the costs a business has to pay for to operate and make money. The meaning of expense is financial burden or outlay : Examples of expenses include rent, utilities, wages, maintenance, depreciation, insurance, and the cost of goods sold. In this blog, we will see what expenses are, how they are recorded, and the various types of expenses, along with an example for better understanding. An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at. Expenses are usually recurring payments needed to. An alternative definition is that an expense is the reduction in value of an. In this blog, we will see what expenses are, how they are recorded, and the various types of expenses, along with an example for better understanding. An expense can also be an. Expense is the cost of running a business. Under the accrual method of accounting, an expense is a cost that is reported on the income statement for the period in which: An expense is the cost incurred in order to generate revenue or obtain something. How to use expense in a sentence. An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a phone bill) and big purchases made by. Expenses are the costs a business has to pay for to operate and make money. Businesses incur various types of expenses. An alternative definition is that an expense is the reduction in value of an. This includes money spent on items such as rent, office supplies, and salaries for employees. Examples of expenses include rent, utilities, wages, maintenance, depreciation, insurance, and the cost of goods sold. Some of the expenses that will be reported on a retailer’s. For example, a person. In this blog, we will see what expenses are, how they are recorded, and the various types of expenses, along with an example for better understanding. Every business has expenses, and in some cases, these costs can be deducted from your. An alternative definition is that an expense is the reduction in value of an. An expense is a type. Expenses are costs that do not acquire, improve, or prolong the life of an asset. Expense is the cost of running a business. Examples of expenses include rent, utilities, wages, maintenance, depreciation, insurance, and the cost of goods sold. An alternative definition is that an expense is the reduction in value of an. An expense is a type of expenditure. For example, a person who buys a new truck for a business would be making a capital expenditure because. In this blog, we will see what expenses are, how they are recorded, and the various types of expenses, along with an example for better understanding. Every business has expenses, and in some cases, these costs can be deducted from your.. Every business has expenses, and in some cases, these costs can be deducted from your. Expenses are usually recurring payments needed to. The meaning of expense is financial burden or outlay : An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a phone bill) and big purchases made by. For example, a. Expenses are the costs a business has to pay for to operate and make money. Businesses incur various types of expenses. An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a phone bill) and big purchases made by. Some of the expenses that will be reported on a retailer’s. Expense is the. An expense is the cost incurred in order to generate revenue or obtain something. An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a phone bill) and big purchases made by. For example, a person who buys a new truck for a business would be making a capital expenditure because. An expense. Expense is the cost of running a business. Under the accrual method of accounting, an expense is a cost that is reported on the income statement for the period in which: Every business has expenses, and in some cases, these costs can be deducted from your. Expenses are costs that do not acquire, improve, or prolong the life of an. The meaning of expense is financial burden or outlay : An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a phone bill) and big purchases made by. Expense is the cost of running a business. Every business has expenses, and in some cases, these costs can be deducted from your. Businesses incur. An expense is the cost incurred in order to generate revenue or obtain something. Expenses are usually recurring payments needed to. Under the accrual method of accounting, an expense is a cost that is reported on the income statement for the period in which: Expense is the cost of running a business. An expense can also be an. An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at. Under the accrual method of accounting, an expense is a cost that is reported on the income statement for the period in which: Expenses are the costs a business has to pay for to operate and make money. How to use expense in a sentence. Some of the expenses that will be reported on a retailer’s. An expense is the cost incurred in order to generate revenue or obtain something. For example, a person who buys a new truck for a business would be making a capital expenditure because. Examples of expenses include rent, utilities, wages, maintenance, depreciation, insurance, and the cost of goods sold. An alternative definition is that an expense is the reduction in value of an. Every business has expenses, and in some cases, these costs can be deducted from your. The meaning of expense is financial burden or outlay : Businesses incur various types of expenses. An expense is money spent to acquire something — expenses includes daily transactions everyone encounters (like paying a phone bill) and big purchases made by. This includes money spent on items such as rent, office supplies, and salaries for employees. An expense can also be an.Deduct medical expenses electronicsgugl

ubbool Blog

Monthly Expense Tracking The First Step to Financial Success World

Expenses On Demand

Expense Meaning, Example, Vs Expenditure, Types

Expenses Free of Charge Creative Commons Financial 14 image

What Are Expenses? Definition, Types, and Examples Forage

Expenses Free of Charge Creative Commons Financial 8 image

Decrease Expenses

Expense Meaning, Example, Vs Expenditure, Types

Expenses Are Usually Recurring Payments Needed To.

Expense Is The Cost Of Running A Business.

Expenses Are Costs That Do Not Acquire, Improve, Or Prolong The Life Of An Asset.

In This Blog, We Will See What Expenses Are, How They Are Recorded, And The Various Types Of Expenses, Along With An Example For Better Understanding.

Related Post: