Amortization Template In Excel

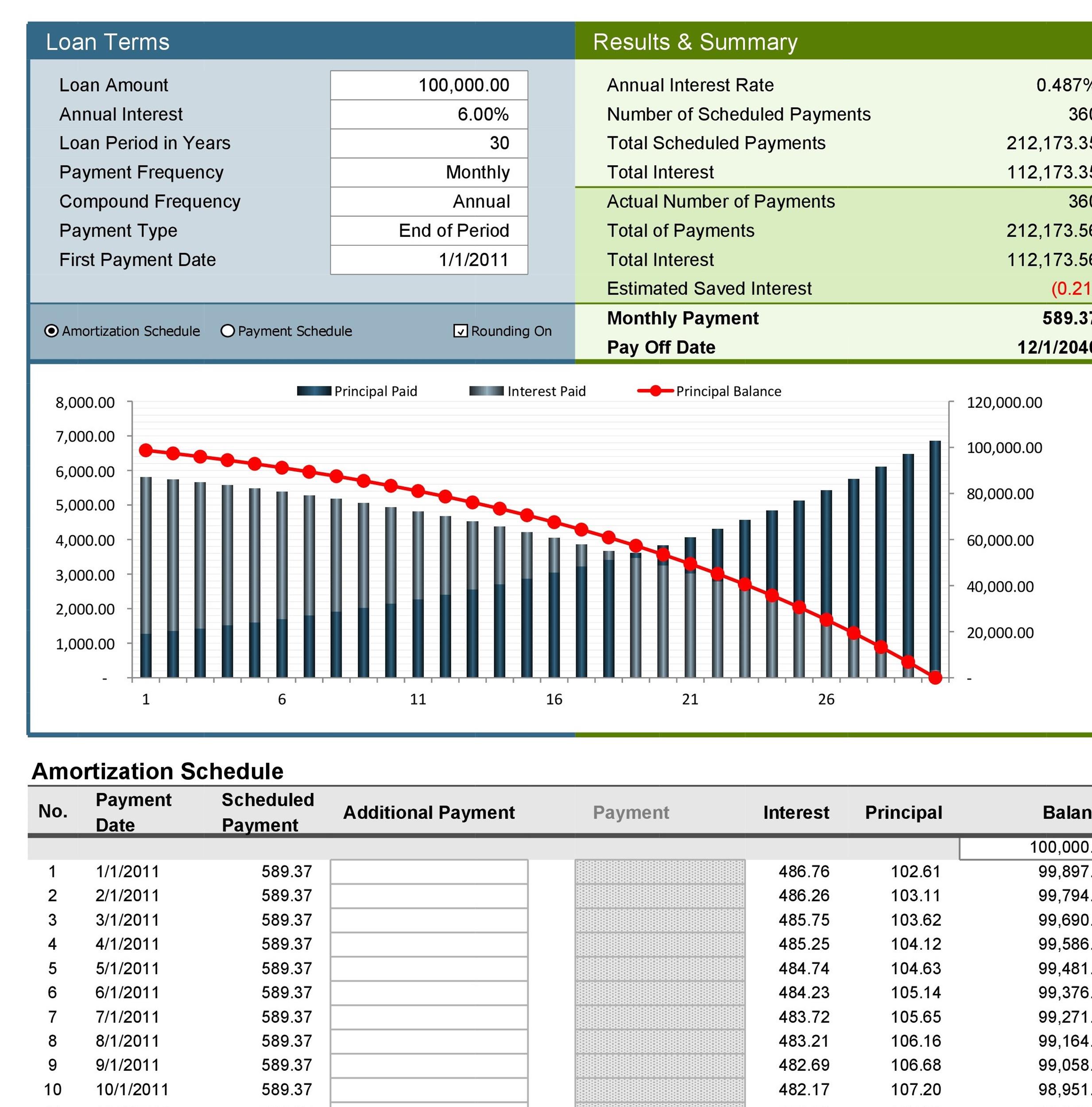

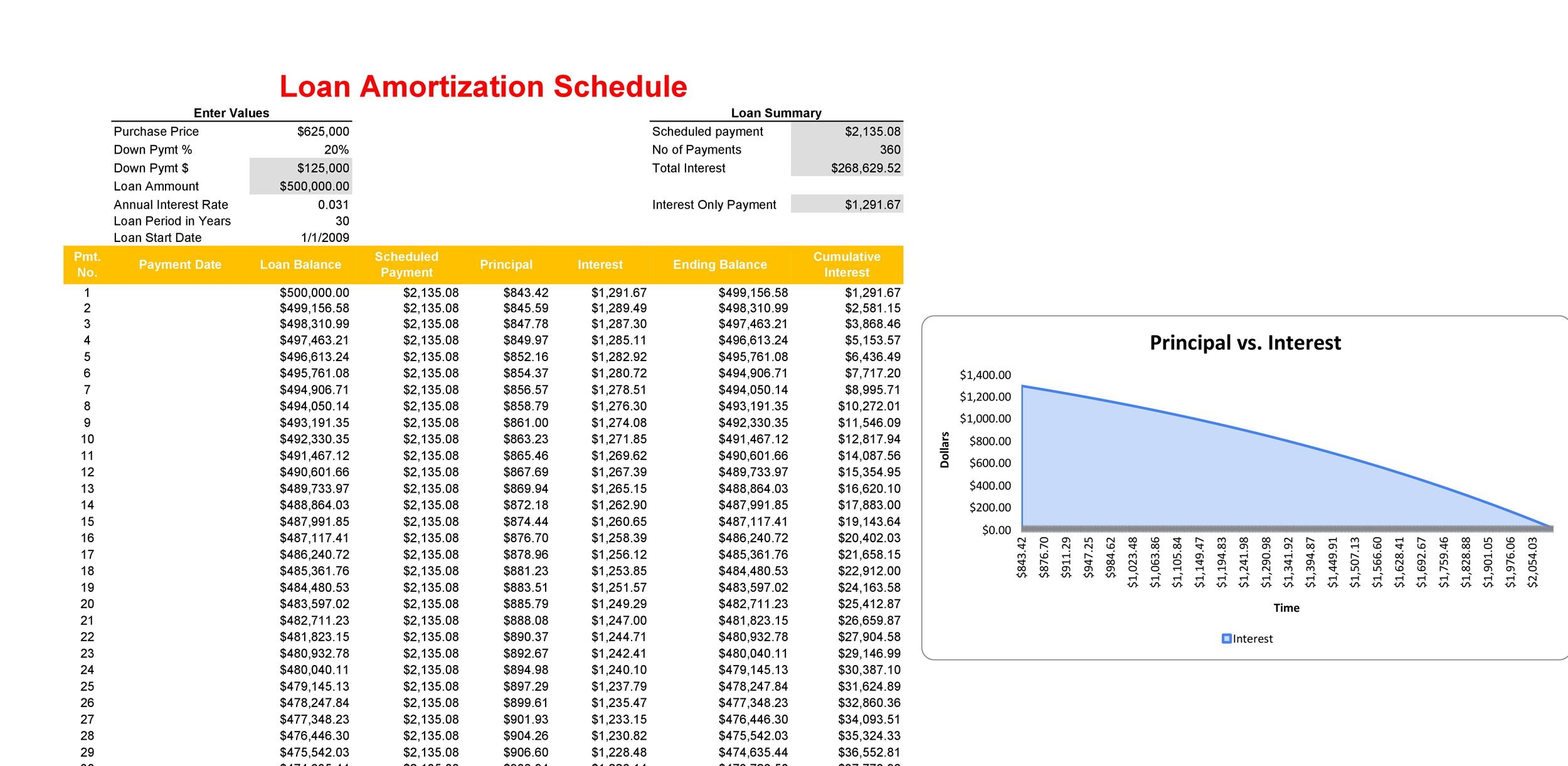

Amortization Template In Excel - An amortization schedule is a chart that tracks the falling book value of a loan or an intangible asset over time. It also determines out how much of your repayments will go towards. In accounting, amortization refers to the process of expensing an intangible asset's value over its useful life. Use this amortization calculator to compute the periodic payment of any amortized loan, for different compounding and payment frequencies. It is comparable to the depreciation of tangible assets. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. Amortization is the process of spreading out the cost of an asset over a period of time. There are different methods and calculations that can be used for amortization, depending on the situation. It aims to allocate costs fairly, accurately, and systematically. Generate detailed amortization schedules instantly. There are different methods and calculations that can be used for amortization, depending on the situation. Amortization is a systematic method to reduce debt over time or allocate the cost of an intangible asset, providing a structured approach to financial management for. In accounting, amortization is a method of obtaining the expenses incurred by an intangible asset arising from a decline in value as a result of use or the passage of time. An amortization schedule is a chart that tracks the falling book value of a loan or an intangible asset over time. Generate detailed amortization schedules instantly. In accounting, amortization refers to the process of expensing an intangible asset's value over its useful life. For loans, it details each payment’s breakdown between principal. Amortization is the process of spreading out the cost of an asset over a period of time. It aims to allocate costs fairly, accurately, and systematically. Use this amortization calculator to compute the periodic payment of any amortized loan, for different compounding and payment frequencies. An amortization schedule is a chart that tracks the falling book value of a loan or an intangible asset over time. There are different methods and calculations that can be used for amortization, depending on the situation. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. In. Amortization is a systematic method to reduce debt over time or allocate the cost of an intangible asset, providing a structured approach to financial management for. It also determines out how much of your repayments will go towards. There are different methods and calculations that can be used for amortization, depending on the situation. For loans, it details each payment’s. An amortization schedule is a chart that tracks the falling book value of a loan or an intangible asset over time. It aims to allocate costs fairly, accurately, and systematically. Use this amortization calculator to compute the periodic payment of any amortized loan, for different compounding and payment frequencies. Amortization is a systematic method to reduce debt over time or. An amortization schedule is a chart that tracks the falling book value of a loan or an intangible asset over time. In accounting, amortization refers to the process of expensing an intangible asset's value over its useful life. It aims to allocate costs fairly, accurately, and systematically. Amortization is the process of spreading out the cost of an asset over. In accounting, amortization refers to the process of expensing an intangible asset's value over its useful life. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. Amortization is the process of spreading out the cost of an asset over a period of time. Generate detailed amortization schedules. Use this amortization calculator to compute the periodic payment of any amortized loan, for different compounding and payment frequencies. It is comparable to the depreciation of tangible assets. In accounting, amortization refers to the process of expensing an intangible asset's value over its useful life. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and. There are different methods and calculations that can be used for amortization, depending on the situation. Use this amortization calculator to compute the periodic payment of any amortized loan, for different compounding and payment frequencies. It aims to allocate costs fairly, accurately, and systematically. It is comparable to the depreciation of tangible assets. It also determines out how much of. It aims to allocate costs fairly, accurately, and systematically. There are different methods and calculations that can be used for amortization, depending on the situation. Amortization is the process of spreading out the cost of an asset over a period of time. Generate detailed amortization schedules instantly. In accounting, amortization is a method of obtaining the expenses incurred by an. In accounting, amortization refers to the process of expensing an intangible asset's value over its useful life. For loans, it details each payment’s breakdown between principal. In accounting, amortization is a method of obtaining the expenses incurred by an intangible asset arising from a decline in value as a result of use or the passage of time. It also determines. Amortization is a systematic method to reduce debt over time or allocate the cost of an intangible asset, providing a structured approach to financial management for. It is comparable to the depreciation of tangible assets. In accounting, amortization is a method of obtaining the expenses incurred by an intangible asset arising from a decline in value as a result of. An amortization schedule is a chart that tracks the falling book value of a loan or an intangible asset over time. It is comparable to the depreciation of tangible assets. For loans, it details each payment’s breakdown between principal. Generate detailed amortization schedules instantly. In accounting, amortization refers to the process of expensing an intangible asset's value over its useful life. There are different methods and calculations that can be used for amortization, depending on the situation. Use this amortization calculator to compute the periodic payment of any amortized loan, for different compounding and payment frequencies. Amortization is the process of spreading out the cost of an asset over a period of time. It also determines out how much of your repayments will go towards. Amortization is a systematic method to reduce debt over time or allocate the cost of an intangible asset, providing a structured approach to financial management for.Amortization Schedule Definition, Example, Difference

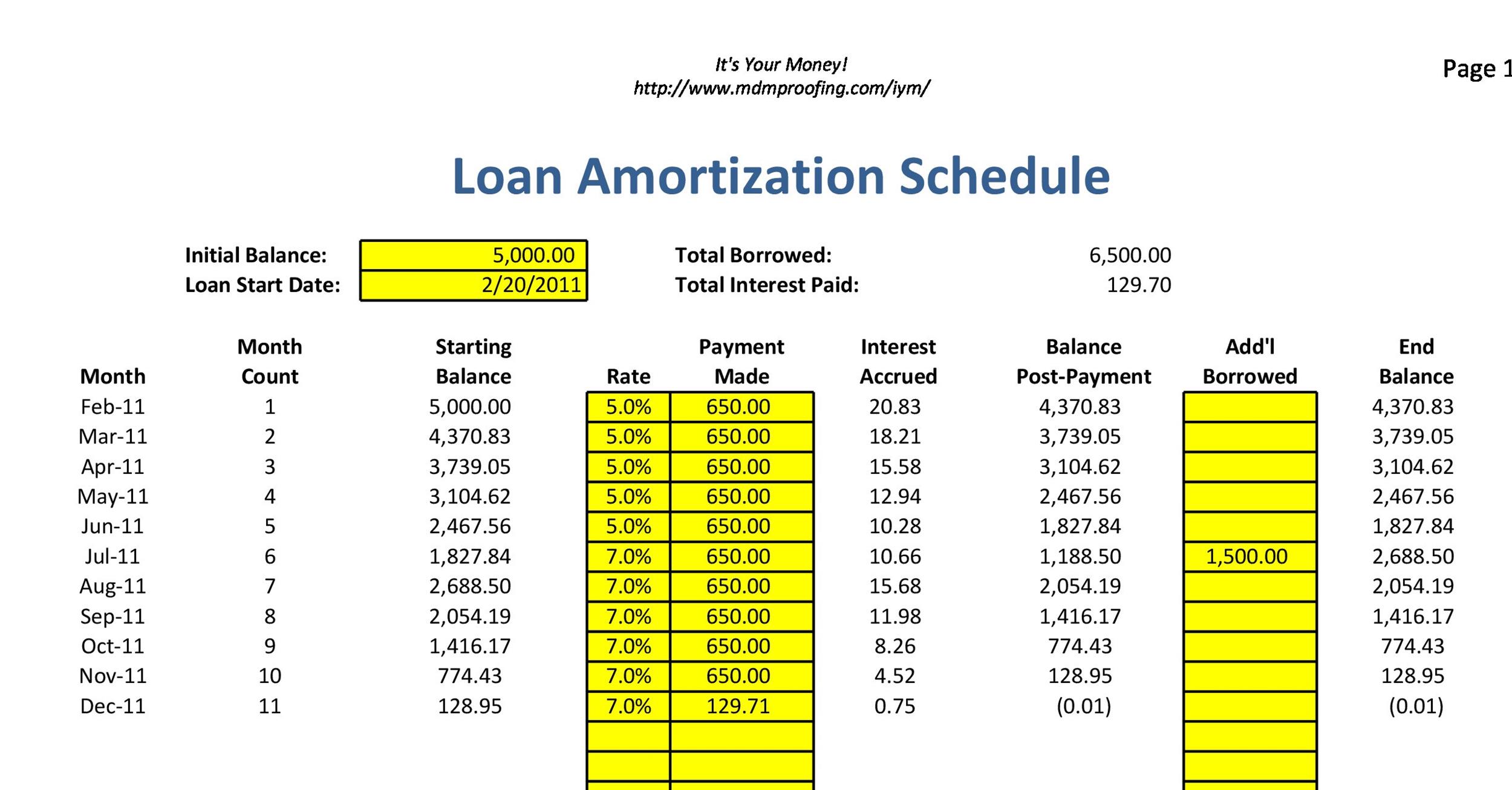

Amortization Schedule Free Printable

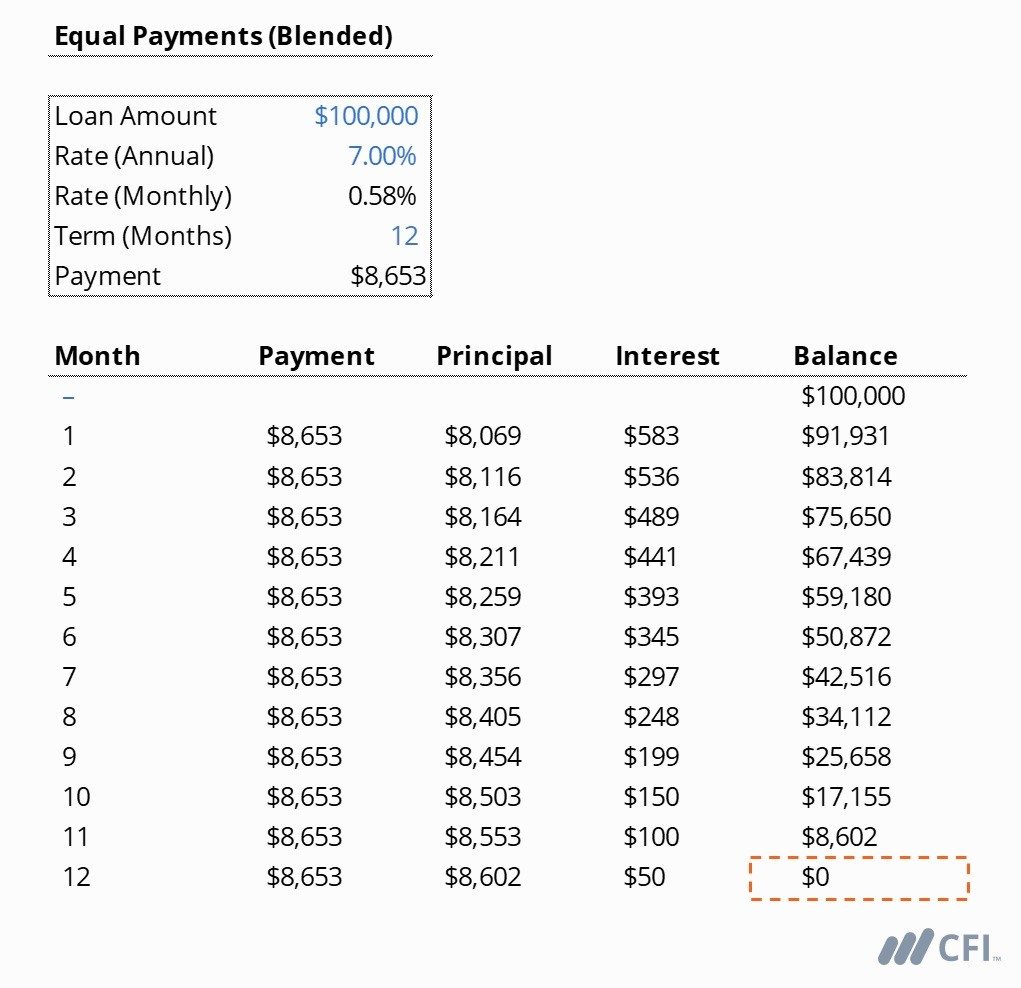

What Is An Amortization Schedule How To Calculate With Formula Equal

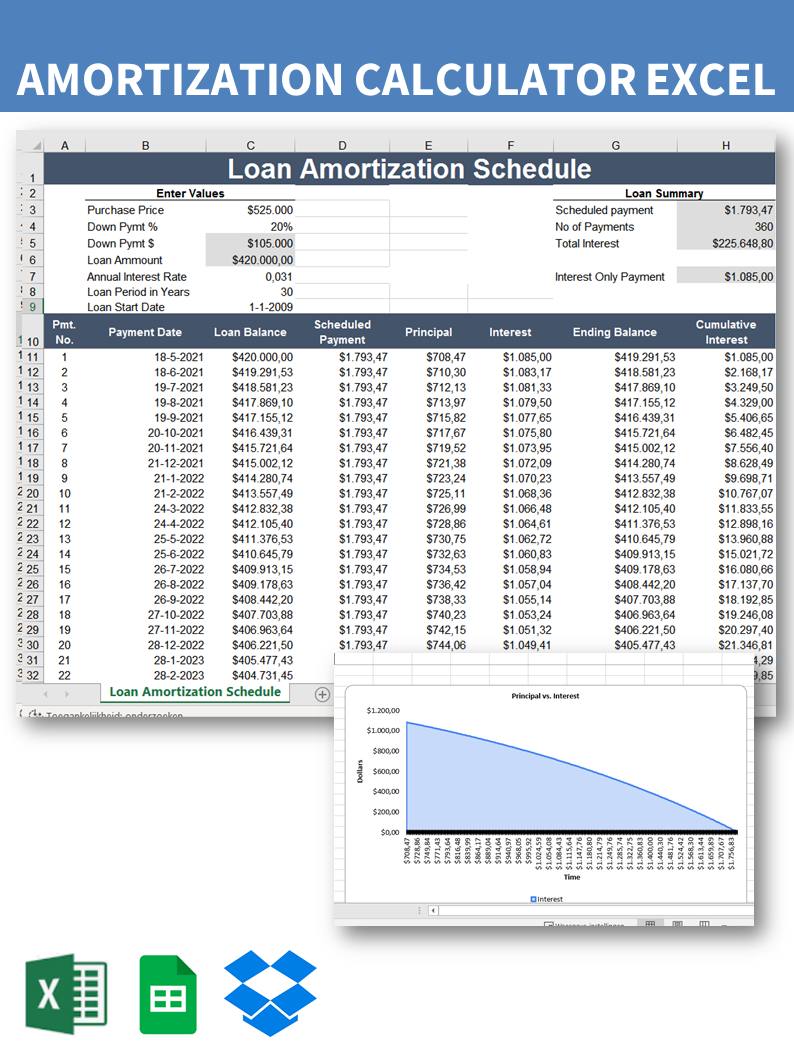

How Do You Create An Amortization Schedule In Excel Printable Online

Excel amortization schedule template microsoft expressfopt

Amortization Tables Excel Template Matttroy

Printable Amortization Chart

Amortization Table Definition Matttroy

What Is Amortization?

What is Mortgage Amortization?

In Accounting, Amortization Is A Method Of Obtaining The Expenses Incurred By An Intangible Asset Arising From A Decline In Value As A Result Of Use Or The Passage Of Time.

It Aims To Allocate Costs Fairly, Accurately, And Systematically.

This Amortization Calculator Returns Monthly Payment Amounts As Well As Displays A Schedule, Graph, And Pie Chart Breakdown Of An Amortized Loan.

Related Post:

:max_bytes(150000):strip_icc()/Amortization_Final_4201631-42b04cd2ad724b96af0c5e8f8fded072.jpg)

:max_bytes(150000):strip_icc()/how-amortization-works-315522_FINAL-8e058e582a744f349593e5c560b46783.png)